Thursday 23 August, 2018

The mining industry downturn began in 2013, but has been showing signs of recovery since early 2017. Industry experts point to declining ore-grades and an improving mining investment cycle as favourable factors for the future of mining consumables manufacturers such as Mincon (LON:MCON).

The market has not been blind to these positive factors. Mincon’s share price is up 120% since Jan16 and shares in other market operators such as Sandvik, and Atlas Copco have also had a similar boost.

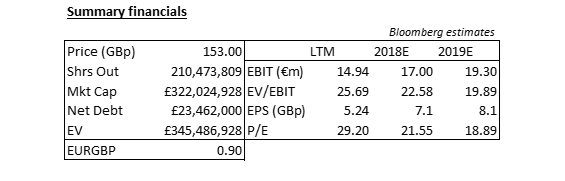

Currently, the market is pricing continued growth in Mincon’s business. It has a market cap of €395m on €12m of 2018E earnings. This valuation roughly prices in 20% compounded growth over the next five or six years.

Mincon is a drill bits manufacturer and distributer supplying primarily to the mining and construction industries. It is an acquisitive business operating in a fragmented market space. Its sales have grown at 20% CAGR and the business has a large family-founder ownership (56%). The 20% sales CAGR, however, is mostly inorganic. Contracting operating margins have caused its operating profits to grow at a much lower rate of 2%, with returns on capital of about 15%.

Mincon supplies to the Mining, Construction, Waterwells, Geothermal wells, Oil and Gas, and Coal Bed Methane industries. The mining industry is by far the largest customer, and due to the long planning cycles in that industry, customers tend to be focused on buying high quality drill components whose durability and efficacy will pay out over the life of the project. The orders from these mining customers also tend to be far larger in value than the orders from the others. The other customers, especially construction, tend to be price focussed due to the “one-off” nature of their projects.

The drill bits Mincon produces tend to be generic fitting, thus a Mincon bit can fit onto a Sandvik drill. When customers become price focussed the manufacturers lose pricing power.

Of late, there has been a consolidation of the players in the mining industry. One consequence of this has been a customer base that has been demanding better pricing on its large orders causing Mincon’s recent sales to these customers to be at tighter margins. While miners need drill bits to operate, and these are a small cost relative to their overall project costs, they don’t need to buy these from Mincon and they are actively working to manage their costs currently.

The two key elements of a long thesis on Mincon are:

- Larger acquisitions going forwards driving sales and

- Operating margin expansion.

Mincon have been selectively acquiring businesses that they know and the highly fragmented nature of the drill bits industry should provide ample opportunity for them to make further acquisitions going forwards, thus increasing sales.

Mincon has seen its operating margins contract from 26% in 2013 to 11% in 2017. While the commodity downturn is partly to blame for this, the cycle has turned, and other successful competitors such as Sandvik, Atlas Copco and Epiroc have all seen their operating margins expand since 2015.

In an attempt to widen its margins, Mincon has been shifting away from selling lower (gross) margin third party products and focussing on selling higher margin Mincon-manufactured products. The large acquisition of Driconeq however will dilute their efforts; the business will represent ~20% of Mincon’s total 2018e sales, but deliver half the gross margin of Mincon’s own manufactured products (25% vs 41% gross margins, respectively). While Mincon management have stated their expectations to widen the margins on this acquired business in the future, it’s not a certainty.

Mincon is a cyclical business, without any clear competitive advantages, growing through acquisitions in a highly fragmented market. At current valuations, I estimate Mincon is overpriced by at least 25%.

I would advise investors to exit Mincon at current valuations.