20th September, 2019

Stabilus (XTRA: STM), is the world leader in the manufacture of gas springs and motorized opening and closing systems with a market cap of €1.5bn. The stock currently represents about 5% of my portfolio, with the potential to deliver about an 14% rate of return over the next decade, which is a sound rate of return.

Investment Thesis

While I believe Stabilus’s dominance in its niche is well-understood and appreciated, what I think the market is undervaluing the option value in the business should there be a materially positive development in the world of Mobility as a Service, or RoboTaxis, where we will be able to sit in a car with no driver, go to sleep and wake up safely at at our destination. I think we’re now at a stage in the development of the technology where we see this type of Level 5 automation on the roads by 2025 with triple digit growth in the adoption of the technology in the first five to seven years thereafter.

So lets now have a deeper look into the business. Stabilus reports under three segments Gas Springs and Powerise, which sell to automakers and Industrials which sells into Industrial customers. I’ll start by talking about Gas Springs because this is where the business started.

History

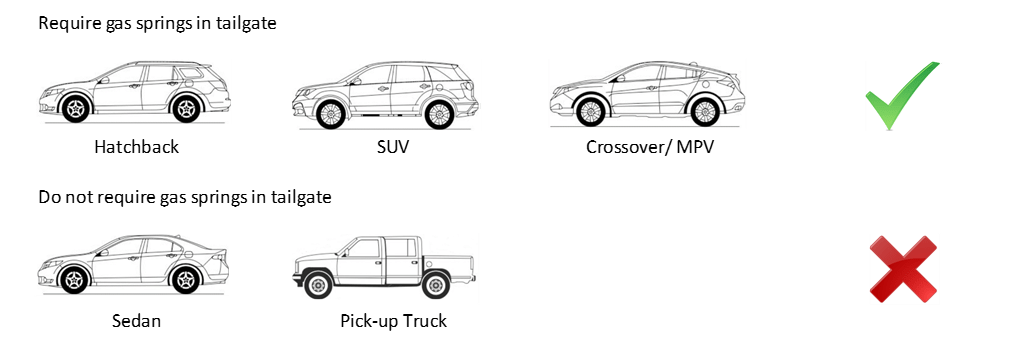

Stabilus is a German manufacturing company that was founded in the 1930s, but its current business model really started to take shape in the late 1960s when the first hatchback cars came about. One trait about these hatchbacks which differentiated them from the traditional sedan or saloon cars was that they were hinged at the roof rather than at the bottom of the back window. This meant that rather than the just the metal trunk-lid rising up, the back glass panel would also go up with the metal boot, and cars with this feature were said to have a “tail gate” at the back as opposed to a “trunk lid” at the back. This is were Stabilus came into play.

Exhibit 1: “Tailgate” vs “not tailgate” vehicles

Source: mechanixillustrated.technicacuriosa.com, bedrug.com

Because a tailgate has to carry the glass panel, while trunk lids don’t, tailgates are far heavier- weighing somewhere between 30-40kg (about 80 lbs) depending on the car- that’s enough weight to break a child’s hand if that tailgate fails to stay up in an open position when it should.

Naturally automakers wanted to find a cost-effective solution but with the potential public liability risk and reputational risk on the line if there was a situation where an end consumer got hurt, the quality and reliability of this solution is far more important then the price they had to pay.

And since the 70s there has only been one technology…

…that has been adopted by automakers, which are gas springs, and Stabilus holds the global monopoly on these with about 70% market share which is 15-times bigger than the number 2 supplier.

Gas Springs are metal struts usually varying between 60 and 70cm long, containing pressurized gas and the length of these tubes and the pressure of the gas within them are unique to the weight burden of the application – a Land Rover requires difference gas springs to a Volkwagen Golf.

Exhibit 2: Stabilus operates a monopoly in gas springs, 15-times bigger than No.2 player

Source: Stabilus

Low cost item for automakers

Stabilus was not only able to consistently provide the automakers with gas springs with zero gas leakage, but was able to sell it to them for €3 each – making it one of the cheapest of the 30,000 components that go into making a car, making it a low priority item for automakers when it comes to price negotiations.

Slow growth market…

In addition to this dominance, Stabilus operates in a market with limited growth potential – annual light vehicle production is about 90m cars and growing about 1-2% per year and even if we account for a continued decline in sedan cars and an increase in Stabilus’s addressable market of cars with tailgates you’ve got an addressable market for gas springs growing at about 4-5%.

…which creates a barrier to entry

This dominance in a slow growth market creates a barrier to entry for anyone looking to displace Stabilus. Specifically, the hundreds of millions of euros a competitor would need to spend to design and replicate Stabilus’s proprietary production machinery would be a low return investment because there’s no real market growth to capture and its unlikely they’ll be able to displace Stabilus’s customers from them.

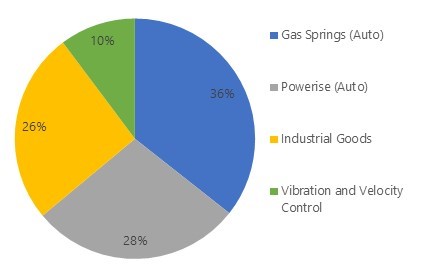

So Stabilus’s Gas Spring segment, which represents about one-third of group’s €1bn in annual sales (about €350m in FY19), is a business with an extremely durable competitive advantage. But given Stabilus already has such a large market share in this space, growth is limited by market growth which is about 5%.

Industrial applications

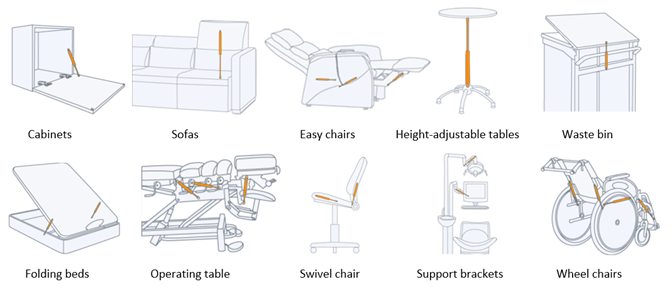

But with these same gas springs, manufactured with the same equipment, Stabilus found that they can also be equally useful in a number of industrial applications from office swivel chairs to hospital beds to reducing the vibrations on solar panels.

Exhibit 3: Stabilus earns higher margins selling smaller batches for industrial applications

Source: Company website

…sold at higher prices and margins

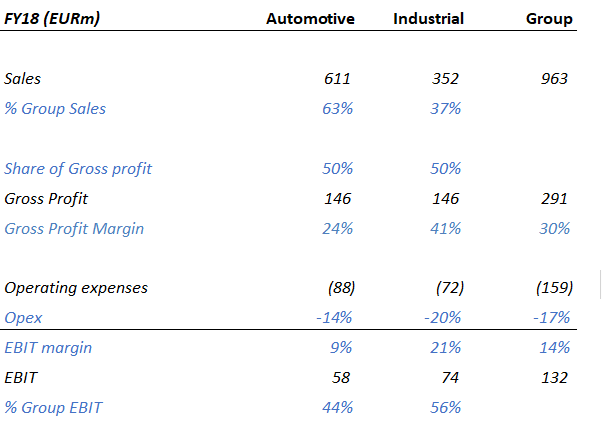

But given these industrial customers buy in much smaller batch sizes relative auto makers, Stabilus are able to sell these gas springs to industrial customers at higher prices and margins, such that the Industrial segment operates with 25% EBIT margins vs 8% EBIT margins in the Gas springs segment. As a result of these higher margins the Industrial business while accounting for only 40% of group sales, accounts for 60% of group FCFs.

Exhibit 4: Stabilus earns higher margins on its industrial sales

Source: The Equity Analyst estimates

Economies of scale

Because the same production machinery is used to produce auto and industrial gas springs, fixed personnel costs related to production can be spread over more units, reducing the cost to produce each unit and manifesting itself in expanding gross margins.

Industrial growth – 7% organic, 15% headline

While the Industrial business line has been growing organically at about 7% the headline growth has been about 15% due to acquisitions. We might well see a similar level of headline growth going forwards given the long tail of smaller industrial gas spring competitors, but this creates the risk of value destruction through overpaying, which is something I’m monitoring.

Summary up to now – Industrial 40%, gas springs 35%

So we have a company with about €1bn in sales, 40% of which comes from selling gas springs to industrial customers and 35% of which comes from selling gas springs to automotive manufacturers. The last 25% is where I see the vast majority of growth coming from and that’s from the supply of Powerise, Stabilus’s motorized opening system to automanufacturers.

Exhibit 5: Revenues by segment, 2019e

Source: Company filings

The Powerise market and value-add to its ecosystem

It’s likely you’ve already seen a Powerise motorized strut in action. About 15% of all cars now open and close with the click of a button or by waving your foot under the car. This is not only more convenient but the sensors that come with this technology stop a boot from closing on a passengers hand, making it safer. In addition this is a feature that car makers love right now because they can buy a Powerise system from Stabilus for about €50 and sell it on as an add on feature or as an inbuilt feature in their cars for about €500. So if we look at the Powerise ecosystem; Stabilus earns about 13% EBIT margins which is decent, the end consumers like the convenience and safety and the automakers are currently earning a 90% margin on this feature.

If we look at the growth trajectory of similar convenience features in cars like heated seats and cruise control I wouldn’t be surprised if this penetration rises from 15% to say 30 or 40% in the next five to six years creating growth of 15-20% in this segment. And given the Powerise segment has grown at a 30% CAGR in the 6years to 2019, this 15-20% forecast may prove conservative.

In addition to the growth potential in vehicle tailgates, we have seen Tesla adopt Stabilus’s Powerise system in their gull wing doors on the Model X. Whats worth noting here is that each door requires 3-4 Powerise devices versus just 1 or 2 in a tailgate. This means that the Tesla Model X, with 2 gull wing doors, has about 8-times the number of Powerise devices in it relative to the average car.

Now you might say, well, but we’re not going to see all cars with gull wing doors, but four other auto makers have put in orders for Stabilus’s door actuator technology, according to management and part of the reason is automakers are preparing for the rise of MaaS or RoboTaxis.

Mobility as a Service requires automatic opening and closing doors because the service can’t be reliant on passengers behaving responsibly and closing doors and boots after themselves.

Autonomous driving technology is developing steadily

Developments in the space are happening quickly. Take for example the fact that the average human drives about 10,000 miles per year and for about 50 years of their lives, without incremental improvement. By contrast Waymo, Google’s autonomous driving unit has 20m recorded miles on its technology. And if you think that’s a lot, Tesla’s Auto Pilot technology which updates everytime any driver of any Tesla takes back over from AutoPilot mode to note the reason for the intervention, has built 3bn miles, And if we just take the 500,000 incremental units Tesla sold in 2020, and assume just 10% of the 10,000 miles these drivers drive in 2021 are on AutoPilot mode this 3bn rises by 500m on just the new cars sold in 2020. There is already strong data that on certain types of road autonomous driving is already far safer than human drivers.

I estimate that we will see the first autonomous vehicles on the road by 2025 and see triple digit growth in the first few years thereafter. In terms of current addressable market, if we take the number of regular drivers reported by the largest ride hailing companies, we have 4m at Uber, 11m at Didi, 2m at Oyo cars, then you’ve got the Lyft in the US. Grab and Go-jek in S.E.Asia, Cabify in South America and the list goes on. In total you’ve probably got about 30m cars that could benefit from driverless cars.

Conclusion

Stabilus is a business with €1.5bn market cap that is worth about €2.3bn and has the potential for 9% FCF growth without MaaS. So assuming a contraction in this 50% discount and adding on a 9% growth rate we could well get a 10 year CAGR on invested capital of about 14%. And if mobility as a service takes off and expands the addressable market for Powerise this long term IRR based on an investment today could rise to the high teens.