Thursday 10th November, 2022

The premiums paid for options are assets accounted for in the balance sheet under “Lot Deposits”, as of September 30, 2022 these were valued at $291m.

Having to walk away from all option premia would be a bad outcome. The impact on the balance sheet would depend on:

- how quickly DFH is forced to make these writedowns, and

- how many inventory units it sells during the same period

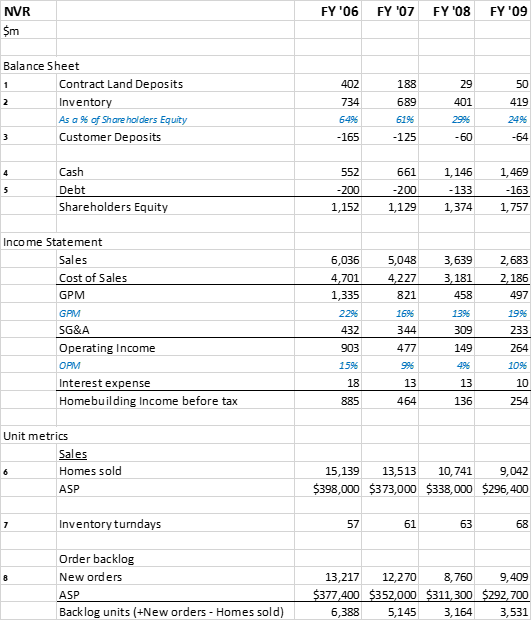

DFH’s current lot deposits of $291m represent about 40% of book at $715m and just over half of tangible book value of $545m (As of Sep 30, 2022). One way I thought to model a “worst case” scenario was to look at NVR during the Global Financial Crisis. (Exhibit 1)

Exhibit 1: NVR wrote down its Contract Land Deposits by 93% during the GFC

Source: Company filings

At the end of FY ‘06, NVR held $402m in contract land deposits [1] vs book value of $1,150m (c.35%). Over the subsequent two years, these deposits were written down by 93%: to $188m in FY ’07, then to $29m in FY ’08. These flow through Cost of Sales, compressing Gross Profit Margins.

Over the same period annual unit sales [6] fell from 15,100 in FY’06 to 13,500 in FY’07 and 10,700 in FY ’08 (-30% total) and ASPs fell from $400k to $340k (-15%).

To put these unit sales into context, at the end of FY ’06, their inventory [2] of homes being built or completed was $730m or about ($730m / [$400k ASP * 80% CoS]=) 2,300 homes. Total inventory at FY ’08 was $400m or about (400m/(340k*87%))=1,360 homes. i.e. inventory shrunk faster than sales, generating cash and buffering the balance sheet.

As a leading indicator NVR probably also noted the falls in new orders [8], which slowed from 13,000 in 2006 to 8,800 in 2008 (-66%).

By adjusting building starts (Inventory) with new orders, inventory turn rates were maintained at c.60days / 2months.

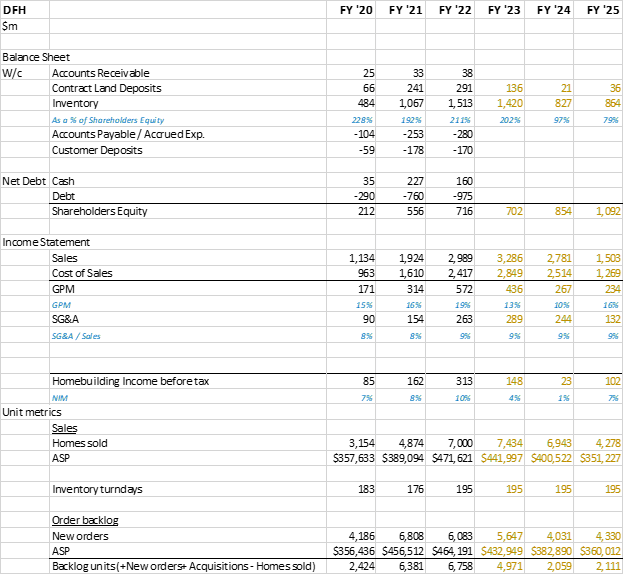

It would be a fair assumption to make for DFH, or any other builder, to adjust their building starts with changes in new orders and thus sustain inventory turn rates. (Exhibit 2)

Exhibit 2: DFH would likely reduce building starts (Inventory) with sales, conserving cash

Source: The Equity Analyst estimates

DFH’s current inventory is $1,500m (September 30, 2022), with ASPs of $470k, Cost at 80% of this, it implies DFH has ($1,500m / ($470k ASP * 81% CoS)) = 4,000 homes in inventory. With inventory turning every 195 days this implies DFH might sell roughly (4,000 * (365/195)=) 7,500 homes in FY ’23.

What is worth comparing here is the percentage of Contract Land Deposits to Inventory x Inventory Turns. This provides an indication of :

If all of contract land deposits were written down in 1 year, but the firm maintained their inventory turn rate, by what percentage would Cost of Sales be increased?

For NVR in FY ’06 the percentage was 8.5% and for DFH in FY’22 its about 10%. With CoS being roughly 80% of sales in both cases, this would roughly imply a 7ppt drop in GPM for NVR in FY ’07 and 8ppt for DFH in FY ’23, in a 2008 style housing market.

Of course there wouldn’t be a 100% writedown of options in 1 year, but there would be some dis-economies of scale so net-net it might be a fair assumption.

Inventory = orders received from customers (who have paid deposits and have initial mortgage approval) versus optioned land. In many cases, customers have played an active role in the custom design of their home while it is being built – so in these cases customers may be walking away from their “ideal home” in addition to their deposit.