Thursday 10th November, 2022

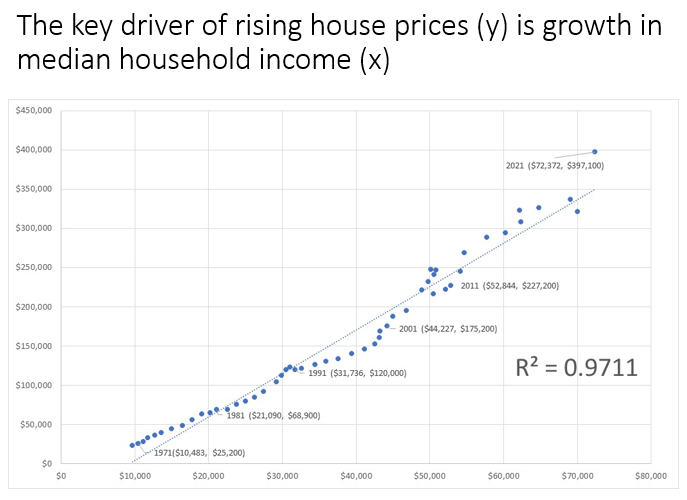

Yes it’s a good spot. Median house prices in the US rose 18% in 2021, following +5% and -2% price changes in 2020 and 2019, respectively. This 18% rise also looks high relative to the median household income line of best fit. (Exhibit 1)

Exhibit 1: The sales prices of new homes in the US shot up 18% in 2021

Source: US Census Bureau

In the short term (in 2023) I would agree it is fair to expect some mean-reversion, which would cause house prices to fall.

However, when forecasting over a 3-5 year window, it is necessary to also incorporate inflation rates into an assessment of future house prices. So far this year, median US house prices are *up* ~9% (the exact change varies based on the data source: US Census Bureau +7.4%, Zillow +10.4%.)

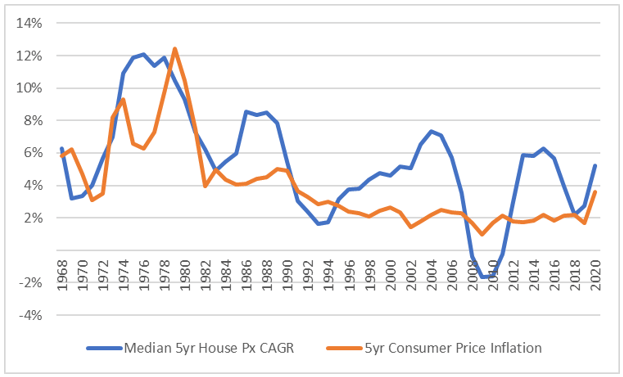

It can be seen in Exhibit 2 below that the CAGR at which house prices have grown have almost always exceeded inflation. With the June 2022 CPI print at 9.1%[1], I think 5.5% CAGR in average new home sales prices over the next 5 years remains fair.

Exhibit 2: The rate of house price growth is almost always above inflation

Source: US Census Bureau

[1] https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category-line-chart.htm