Background

ARLP is the second-largest coal producer in the eastern United States. It makes and sells “steam coal” – coal burned to produce steam for the production of electricity – for utilities and industrial companies.

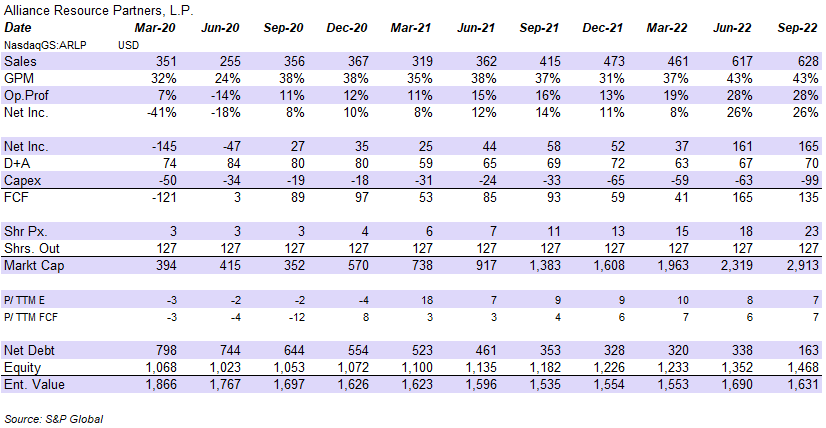

Looking at historic financials (Exhibit 1), we can see the business has seen a near doubling in quarterly sales from $319m in the first quarter of 2021 to $628m in the third quarter of 2022.

Exhibit 1: Historic Quarterly Financials

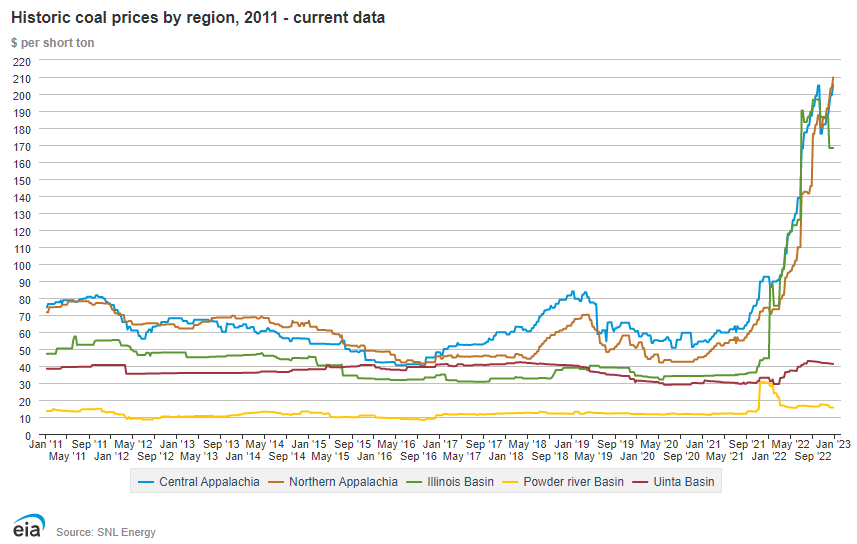

With its two key operating segments being: Illinois Basin and Appalachia, it has likely benefited from the near tripling of coal prices in these regions from c.$70 per short ton in January 2021 to c.$210 per short ton at the end of 2022, near all time highs. (Exhibit 2)

Exhibit 2: ARLP has benefitted from the record rise in coal prices

According to an IEA press release in July 2022, the rise in coal prices has been driven by increased demand from India and users switching from using natural gas to coal:

“Global coal demand is being propped up this year by rising natural gas prices, which have intensified gas-to-coal switching in many countries, as well as economic growth in India. Those factors are being partly offset by slowing economic growth in China and by the inability of some major coal producers to ramp up production.”

IEA, “Global coal demand is set to return to its all-time high in 2022”, 28 July 2022

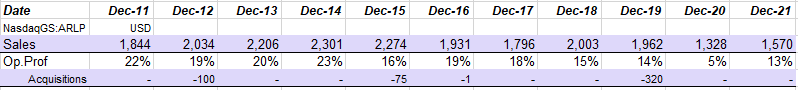

What is striking is the company’s poor acquisition record. Despite having spent c.$500m on acquisitions between 2011 and 2021, company sales are down $300m as are operating margins, from 22% in 2011 to 13% in 2021 (Exhibit 3).

Exhibit 3: Despite burning $500m on acquisitions, ARLP has seen sales and margins decline

Over the same 10 year window, coal prices are largely unchanged (Exhibit 2), potentially highlighting the operating headwinds facing coal producers generally and specifically, a poor capital allocation record on the part of ARLP.