Saturday 21st January 2023

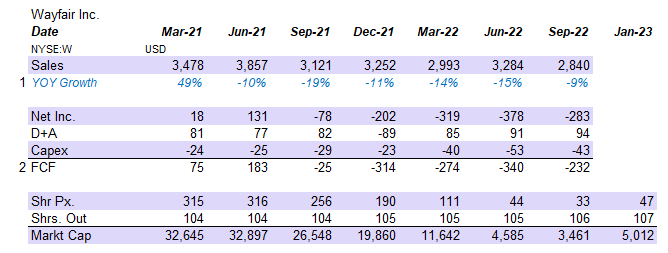

Since hitting its peak valuation of $33bn, or $330 per share in the Summer of 2021, Wayfair has:

- Posted double-digit declines in revenues, YoY. This caused it to give back the market share gains it made during the COVID lockdowns

- Been burning through ~$300m in cash in each of the four quarters to September 2022

It is unsurprising shares fell ~90% to $33 over the period.

My analysis of St. Louis Fed Economic data in conjunction with relevant quarterly segment sales data of the main US home goods retailers appears to suggest the key driver of company sales in the years during and after COVID have been their exposure to the high-street and online sales channels.

If true, my original thesis that Wayfair provides a superior offering for suppliers and customers and can achieve 8% FCF-yields by 2030 likely remains intact.

Online only players such as Wayfair and Overstock saw market share gains in 2020, which have subsequently been given back. Whereas the more balanced businesses of Williams Sonoma and RH have maintained market share over time. Bed, Bath and Beyond, which had a minimal online presence pre-COVID got battered and looks like it might not survive.

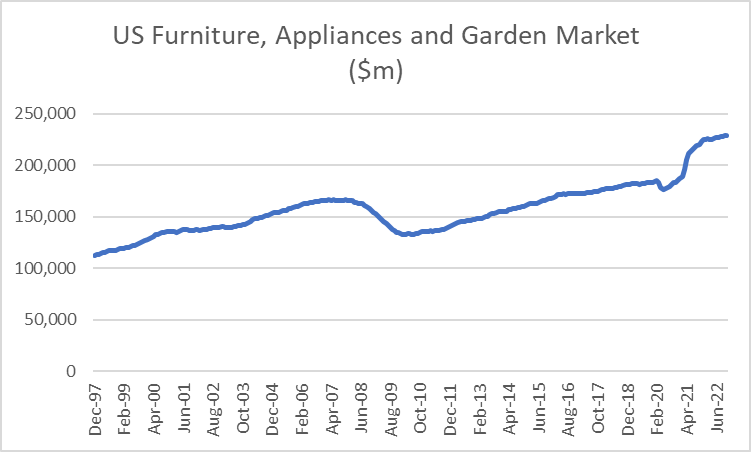

The US Furniture, Appliances and Garden Equipment market has shown slow but steady growth in recent years, with strong pick up in demand in 2021 (Exhibit 0)

Exhibit 0: US Home Goods market has shown some growth in 2021

Source: Federal Reserve Economic Data

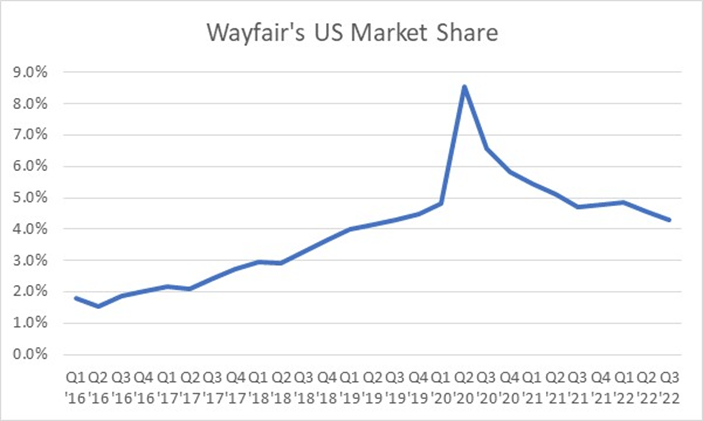

By contrast, Wayfair’s rapid growth pre-COVID and lockdowns enabled its market share to rise to 8.5%, before coming back down to levels seen in 2019, as lockdowns eased. (Exhibit 1)

Exhibit 1: Wayfair has given back the market share gains it made during COVID lockdowns

Source: Company filings, Federal Reserve Economic Data

What’s important to remember is that it is likely this share loss dynamic is a function of Wayfair being an online only home goods retailer. Meaning it is possible this market share gain and subsequent loss are largely a function of consumers shifting their spending almost exclusively online, and then back to the historic online-high street mix of the past.

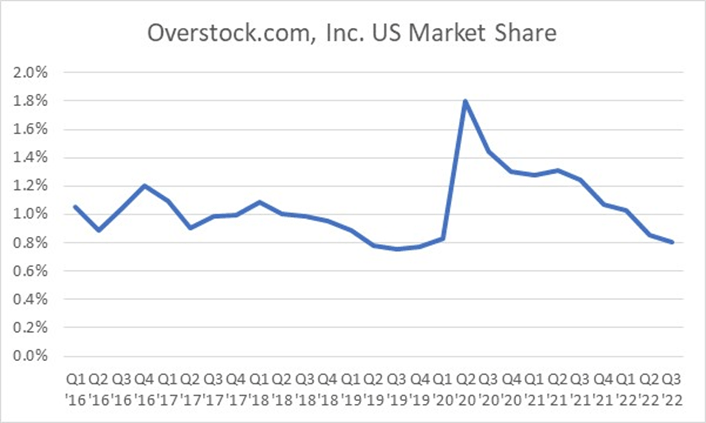

If this hypothesis were true, we would expect to see a similar market share dynamic in other online-only home-goods retailers in the US. The only other online-only competitor I have been able to pull US sales data on is Overstock.com, whose market share appears to follow a similar pattern, albeit at a lower market share level. (Exhibit 2)

Exhibit 2: OverStock.com, an online-only home goods retailer, has also lost market share post COVID

Source: Company filings, Federal Reserve Economic Data

The flip side of this dynamic is to look at home-goods retailers that had a minimal online presence before COVID and had to play catch up. Here the poster child is Bed, Bath and Beyond. As can be seen in Exhibit 3 below, the business looks to be on track for bankruptcy. (Exhibit 3)

Exhibit 3: Bed Bath and Beyond had no pre-COVID online presence and is struggling to catch up

Source: Company filings, Federal Reserve Economic Data

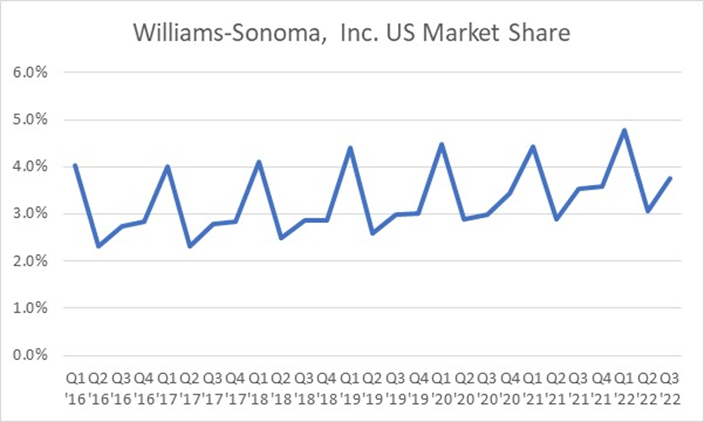

In between these two extremes we have companies like Williams Sonoma and Restoration Hardware (RH) who generated revenues online as well as on the high-street pre-COVID. Here we see they both managed to retain their market share through the period, with the mix-shift likely shifting to online during lockdowns. (Exhibits 4 and 5)

Exhibit 4: Williams Sonoma has managed to maintain market share over time likely as a result of having an online presence in addition to high-street shops

Source: Company filings, Federal Reserve Economic Data

Exhibit 5: …similarly with RH

Source: Company filings, Federal Reserve Economic Data