Sunday 22nd January 2023

Thesis

BUY Activision Blizzard (ATVI) shares for $75 in anticipation of Microsoft (MSFT) acquiring them for $95 in September 2023, after the likely approval by US, UK and EU competition committees.

If successful, it returns 27% in 8 months, representing a 36% annualised rate of return. If the deal doesn’t go through we may not even fall to the pre-announcement $65 (-13%) because of the cash MSFT would have to pay ATVI for break-up (currently worth $3 per share, rising to $4 in April).

By March 2023, September options on ATVI are likely to become tradable, potentially opening up the opportunity to trade an option strategy that can deliver a 10 to 1 return.

Currently the ATVI June-2023 80-90 Call Spread can be bought while selling ATVI June-2023 65 Puts for around $1. The same structure with a September maturity may be available for a similar price in late March or April.

If the merger completes at $95 we make a 10-1 return, if it doesn’t close and ATVI shares fall to $68 ($65 + $3) we lose our $1 premium. And if ATVI shares fall below $65, in the worst case, we get to own Activision Blizzard, a leading games maker, at $65 per share (30x trailing earnings).

- Thesis

- Background

- The deal is not anti-competitive

- Owning ATVI if deal breaks is not bad

- Appendix 1: Timeline

Background

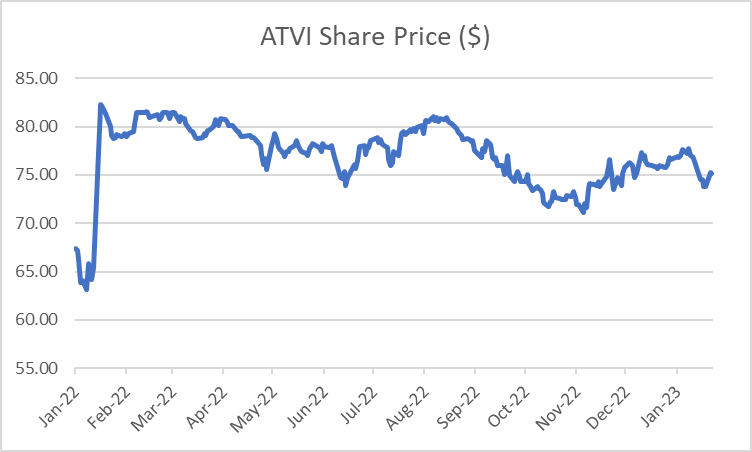

When Microsoft (MSFT) announced its intention to buy ATVI shares in January 2022 for $95 each, prices jumped from the previous day’s closing price of $65 to $82. Since then, ATVI shares have traded gradually down to the current $75 level (Exhibit 1)

Exhibit 1: Concerns about the deal being blocked have caused ATVI shares to trade down

Source: Capital IQ

Between the $65 start price to the $95 bid, the current $75 price implies the market is pricing a 1 in 3 chance the deal will close. This seems too low to me.

The deal is not anti-competitive

At the time when Microsoft announced the deal they had the goal of closing by June 2023, 5 months from now. However, on the 8th December 2022, the US Federal Trade Commission announced its decision to challenge the deal claiming it is anti-competitive.

FTC is probably wrong to think Call of Duty will be made exclusive to Xbox

The FTC said Activision Blizzard has brought its games to a variety of devices, irrespective of their manufacturers, but that might change if Microsoft were to complete the deal. Microsoft could adjust prices or worsen the experience on competing hardware such as Sony PlayStation consoles, or keep Activision Blizzard consoles from reaching consoles other than Microsoft Xbox systems, the agency said. A key concern of the FTC is that Microsoft will make the highly successful Call of Duty game exclusive to Xbox.

“The agency alleges that the deal would enable Microsoft to suppress competitors to its Xbox gaming consoles and its rapidly growing subscription and cloud-gaming business.”

–FTC Microsoft/ Activision Blizzard Case Summary

It’s not in Microsoft’s economic interest to make Call of Duty exclusive

This statement appears to overlook MSFT’s economic incentives. In a note to investors, Jeb Boatman, Senior Vice President of Litigation, Regulatory, and Public Policy Law at Activision Blizzard highlighted why it is not in Microsoft’s interest to make Call of Duty exclusive to Xbox:

“Making Call of Duty exclusive to Xbox doesn’t make good business sense. Microsoft would lose billions of dollars in lost sales and would infuriate both PlayStation owners (who would lose Call of Duty) and Xbox owners (who would lose the ability to play with their friends who own PlayStations). The player backlash would be disastrous. It would destroy Microsoft’s trust with players and its brand, something Microsoft has spent decades building and protecting.”

-Jeb Boatman, Senior Vice President of Litigation, Regulatory, and Public Policy Law at Activision Blizzard, 8th Dec 2022

While the reputational risk argument appears solid, MSFT’s economic incentive argument is what the FTC is targetting. In its announcement the FTC stated:

“Microsoft decided to make several of Bethesda’s titles including Starfield and Redfall Microsoft exclusives despite assurances it had given to European antitrust authorities that it had no incentive to withhold games from rival consoles.”

–FTC Statement, 8th Dec 2022

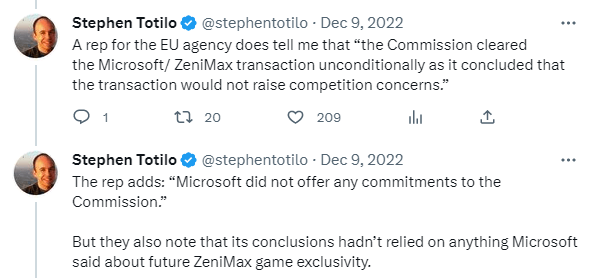

But the FTC is wrong, and EU competition officials are telling them as much. In a conversation with Steven Totilo, a video games reporter for Axios, an official from the EU competition commission highlighted that Microsoft made no promises about future exclusivity (Exhibit 2)

Exhibit 2: EU officials say MSFT didn’t make any commitments to them

Source: Twitter

This weakens the FTC argument that MSFT will renege on a promise and make Call of Duty exclusive to Xbox at a later stage.

Microsoft has already signed non-exclusivity agreements with key competitors

On December 7th 2022, Microsoft announced the signing of 10 year contract with Nintendo (Exhibit 3) came shortly after Microsoft President Brad Smith said company has offered Sony a 10-year contract to make each new release of Call of Duty available on Sony’s PlayStation console at the same time as the Xbox.

Exhibit 3: Microsoft has locked in non-exclusivity for a decade

Microsoft has said it plans to release Call of Duty games on multiple platforms for years as well as producing mobile and cloud versions of the game.

Importantly, as a part of the Sony deal ATVI games will now be available on PlayStation Plus, their subscription service, which they weren’t previously. This indicates the MSFT-ATVI deal will increase consumer choice.

Microsoft’s gaming chief Phil Spencer said that the firm has also “committed” to offer Call of Duty on Steam, an online game distribution platform, simultaneously to on its own streaming platform Xbox Game Pass after the close of the deal.

Microsoft has stated it is eyeing non-console growth from this acquisition

In an interview with the WSJ in November 2022, Microsoft’s gaming chief Phil Spencer highlighted that the opportunity MSFT sees in this deal is really around mobile, not about bringing player’s onto its Xbox platform:

“This opportunity is really around mobile for us…when you think about 3bn people playing video games, there’s only about 200m households that play on console. The vast majority if people play on the device that’s already in their pocket. What really interested us in Activision was the great work they had done in building out such large mobile followings.”

-Phil Spencer, Microsoft Gaming CEO, 4th Nov 2022

Subscription services for the streaming of games (such as Microsoft’s Xbox Game Pass) continue to make inroads. There may well come a point where consumers can play “Triple A games” – those with higher development and marketing budgets than other tiers of games – over the cloud without the need for consoles or gaming computers.

Owning ATVI if deal breaks is not bad

- Backstop: The amount MSFT has to pay ATVI if the FTC blocks the deal just went up from $2bn to $2.5bn – the equivalent of about $3 per ATVI share ($2.5bn/783m shares outstanding)

As of 18th January, we have just entered the second phase of the acquisition timeline in which the fee for Microsoft to back out from the deal has increased from $2 to $2.5bn. From April 18th this steps up again to $3bn (Exhibit 4)

Not only does this add pressure on MSFT to close the deal, it also increases the buffer of protection buyer’s of ATVI shares get. With 783m shares outstanding this $2.5bn of cash MSFT would pay adds $3.19 per share in value to ATVI, rising to $3.83 from April 18th.

Exhibit 4: The termination cost Microsoft would have to pay ATVI just increased by $500m

Source: ATVI 8-K, 19th January 2022

- A market leader: ATVI is home to billion dollar game franchises including Call of Duty, World of Warcraft and Candy Crush -one of the most popular mobile games in the world, with ~250m monthly active players. The group has 400m MAPs across 190 countries.

- Growing market: Gaming is the largest and fastest growing category in entertainment. Today, 3bn people play games, which MSFT expects to grow to 4.5bn by 2030 (5% CAGR).

- Net cash on balance sheet

Appendix 1: Timeline

18 Jan 2022: Microsoft announces plan to acquire ATVI for $68.7bn cash ($95 / share)

30 Jun 2022: CWU writes to FTC in support of merger (CWU announcement)

6 Jul 2022: UK CMA opens investigation into merger (CMA Case page)

8 Dec 2022: US FTC announces it seeks to block the merger (FTC Case page)

26 Apr 2023: UK CMA Statutory deadline for investigation (CMA Case page)

2 Aug 2023: US FTC Commencement of hearing 10am E.T. (FTC Scheduling Order)