Friday 24 February 2023

I believe investors are overconfident in their thinking that inflation is now under control and hence we are likely to see an easing of rates in the next year. If they turn out to be wrong, we may well see markets reverse the gains they have made by the middle of this year. The key metric I am currently monitoring to evaluate if investors are wrong is the US Core Inflation, as opposed to US headline inflation.

So let’s dig in. Let’s start by taking stock of what has happened…

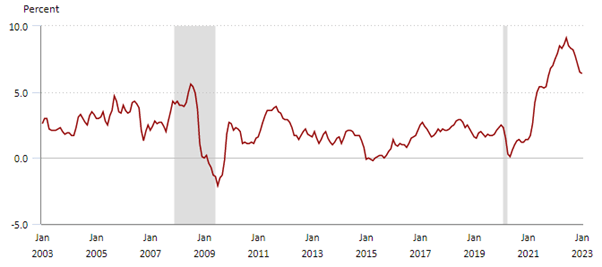

Since October 2022, equity and bond markets have rallied strongly in the belief that inflation is set to subside, believing this in turn will cause central banks to cut interest rates. The reason they have largely believed this is because between June 2022 and January 2023 US headline CPI, one of the most widely watched inflation measures, has steadily fallen from 9.1% to 6.4% (Exhibit 1)

Exhibit 1: Investor optimism stems from US CPI fall from 9.1% in Jun-22 to 6.4% in Jan-23

Source: https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category-line-chart.htm

In the US, the SPX is up about 15% since the lows seen in October 2022, with stocks having an average multiple to earnings of 18x. To put this multiple into context, this 18x P/E multiple means the market is pricing the earnings of US companies will grow by 10% on average, in 2024.

A similarly optimistic picture can be seen in corporate bonds, where an index of investment grade corporate bond prices is over 9% over the same period.

These imply the strong investor concerns of a recession from just a few months ago, have now been all but forgotten.

On the rates front, looking at bond prices of many OECD countries we can see the market is pricing that central banks around the world will start loosening monetary policy within a year. And the price of US inflation-linked swaps suggests the US CPI will rise by just 2.9% over the next year.

So combining these data points (the rallying of stock markets, the rise in prices of IG corporate bonds and the pricing of rates cuts) we can see that investors appear to be betting that the cost of goods and labour is set to stabilise. And with this stabilisation in inflation, the rate cuts that follow will reduce the cost of capital for corporations, boosting corporate earnings and thus help major economies avoid a recession – most importantly, the belief the US will avoid a recession.

There are some important factors to remember when evaluating if the market is currently correct in its pricing.

Historically, the US Fed has a terrible track record at delivering “soft landings” – most rate hike cycles have historically been followed by recessions. In the past 50 years, there have been 8 tightening cycles and 6 of them were followed by a recession – the exceptions were 1984 and 1995. What’s concerning, is that both those “soft landings” were preceded by relatively low inflation and accompanied by looser bank-lending standards – the exact opposite conditions to what exist today.

A second datapoint worth weighing is that the most recent rate hike cycle has been the steepest rise in rates seen since the 1980s, and more rate hikes than are currently priced may be required.

The third datapoint, and the most predictive, is the gap between the 10-year and 3-month Treasury yields, which turned negative last October. This is the ninth time in the past 50 years this spread has turned negative. All eight of the past instances were followed by a recession.

Based on these factors I currently believe the balance of odds suggests a recession in the US is probable in 2023.

Part of the discrepancy is being caused by where investors are focussed.

While investors are pleased by the decline in headline inflation levels caused by falling energy prices and unplugging of supply chains, central banks are more cautious because of what they see beneath the headline number. Specifically, they are concerned by the rising level of core inflation, which is being driven higher by prices in services sectors, which are largely a function of labour costs.

With six of the seven G7 countries currently operating with extremely tight jobs market – with levels of unemployment at the lowest level this century – and twice the number of job openings as there are people looking for work, companies are struggling to hire staff. In many countries including the US, competition for workers continues to create wage growth that is too high to permit inflation of just 2%. This would imply investors betting on rate cuts by year end are likely to be proved wrong.

The low unemployment levels will likely support wage growth for some time. If inflation does not fall as investors expect interest rates will stay high or rise further. Stock markets would face a double whammy, from a higher discount rate, which mechanically reduces asset prices, and an even higher risk of recession. This would call for a defensively structured portfolio.