April 2019

In April 2019, while working for StockViews, I wrote up a BUY note on Nolato, the Swedish specialist plastics manufacturer.

The stock had fallen 50% in 9 months on the back of concerns the key revenue driver was faltering; the manufacture and sale of Vaporiser Heating Product (VHP) smoking devices to BAT.

In July 2018, the Wall Street Journal had reported on the Philip Morris injunction on the sale of BAT’s “glo” VHP devices in Japan (its largest market) on patent infringement grounds. If BAT could not sell in Japan, it wouldn’t need Nolato to make anywhere near the same number of devices for it.

Through my primary research, I found the market had overlooked a key detail in the patent infringement filing. Namely that the ban was only applicable to the current VHP model, and Nolato was set to release the new model for BAT within months.

By emailing and getting response from BAT’s general council I was able to verify this fact.

Furthermore, BAT’s reliance on the Japanese market was likely to diminish over time as the company rolled out its product into new markets. BAT had 2m customers across 15 markets, while PMI – the market leader- was already in 45 and had 10m+ customers of their IQOS product, including the US. BAT had filed a “substantial equivalence” application with the FDA and was likely to gain approval given its direct competitor IQOS had been approved.

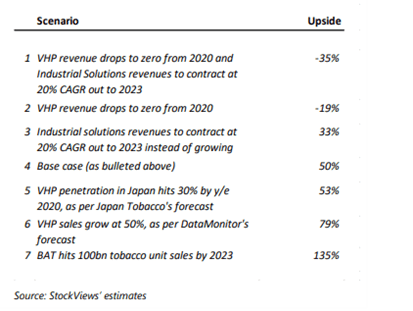

In terms of pricing the market was largely pricing a 4 in 5 chance that this division would be a zero going forwards. By contrast my detailed modelling, of expansion into new markets and addressable markets in each, forecast a more than doubling of sales in the next three years.

In my base case I saw 50% upside, while also taking the time to model the impact of various potential scenarios: