Inflated related-party loan sales risk SEC probes and significant falls in EBITDA ahead

Our investment in Carvana has been a great one, but now it is time to sell out.

From our first purchase of shares in May 2022 at ~$40 per share, we took profits on 75% of our position in Oct 24 and Nov 24 at ~$170 and ~$230 per share — about 400% and 600% returns, respectively. The remaining 25% has an unrealised gain of 1,000%. (Makes me think we should have kept holding onto the whole lot!)

The reason why we held Carvana through this period was the impressive operational advantages it appeared to be gaining over its peers through its vertically integrated model, with a long runway of growth potential through market share capture.

However, valuations do matter when thinking about returns. Shares currently trade at 91 times trailing twelve month earnings and 72 times TTM free cash flow, suggesting high growth expectations. They were trading at over 100-times these multiples on our initial sales.

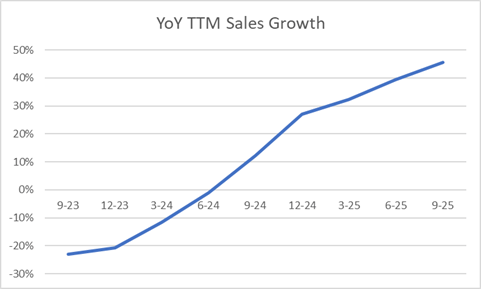

Bulls, however, would rightly point out that our previous sales proved premature and sales growth has been accelerating, justifying the high multiples (Exhibit 1)

Exhibit 1: Carvana sales growth has been accelerating, on rolling TTM basis

Thus, in and of itself, the valuation argument is a weak one.

Key concerns of aggressive earnings management, however, have been raised in a recent “short seller” report by Gotham City Research on the 28th January 2026. Gotham has claimed that Carvana’s reported profits have been materially driven by related-party transactions that shift economic losses away from its public books and onto an affiliate. According to Gotham City Research’s report, a large portion of Carvana’s reported gains on finance receivable sales appears to come from selling loans at inflated values to a related entity (DriveTime, a company controlled by the father of Carvana’s CEO). This effectively shifts economic losses onto that affiliate while boosting Carvana’s public-facing earnings.

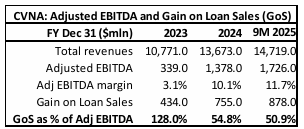

These Gain on Sale profits accounted for 55% of Carvana’s 2024 EBITDA ($755m vs. $1,378m total).

Source: Gotham City Research Carvana Full Report

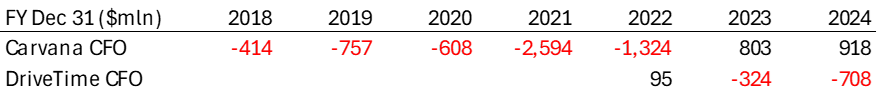

These sales at an inflated price, helped Carvana go from having negative Cash Flow from Operations in all years prior to 2022, to positive in 2023 and 2024. Shockingly, DriveTime posted operating losses at just the time Carvana posted their gains, supporting Gotham’s claim that the private company DriveTime is taking on losses enabling the publicly traded Carvana to post profits.

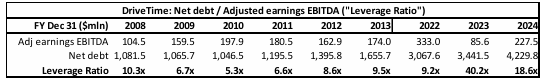

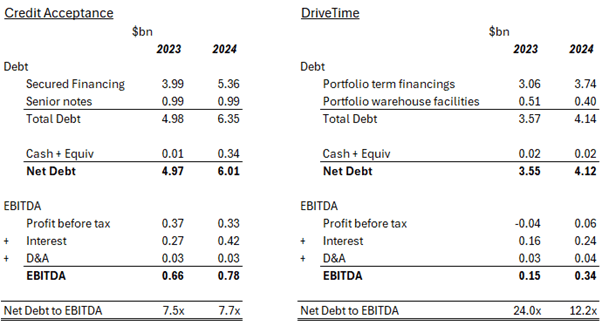

To fund these losses – and the purchases of the loans from Carvana – DriveTime has taken on a tonne of debt. Gotham’s report claims DriveTime’s net debt is “20-40x 2023 and 2024 Adjusted EBITDA, well above the historic level of 5-10x”.

Source: Gotham City Research Carvana Full Report

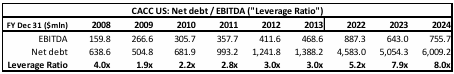

Gotham’s report also states this level of leverage is way above another U.S. Subprime Auto Lender, Credit Acceptance, who’s Net Debt to EBITDA was closer to 8x in 2023 and 2024:

Source: Gotham City Research Carvana Full Report

By going through the annual reports for both DriveTime and Credit Acceptance I was able to verify Gotham’s figures. While my calculations for DriveTime’s leverage at 10-25x, was lower than their calculation, it’s still an incredibly high level of leverage, and around double that of Credit Acceptance:

The key concern now is, once the lenders read this report, DriveTime will struggle to borrow more, and hence will no longer be able to buy Carvana’s loans at a premium.

We’ll find out for sure if this is true in the next few quarters. If DriveTime stops buying at a premium, Carvana’s source of half its EBITDA will disappear.

In ending, it’s worth mentioning that in October 1990, Ernest Garcia II (owner of DriveTime) pled guilty to a federal bank fraud charge related to his role in the collapse of the Lincoln Savings & Loan Association — a major savings-and-loan institution at the centre of a high-profile financial scandal in the late 1980s and early 1990s. Prosecutors said Garcia acted as a “straw borrower” – he was a real estate developer who took out loans in his own name to conceal Lincoln’s true exposure to certain real-estate assets from regulators.

The wrongdoing was about misrepresentation in lending and disclosure – which looks to be the same thing happening here.